Facts about Banks

Banks' activities can be characterized as retail banking, dealing directly with individuals and small businesses, and investment banking, relating to activities on the financial markets.

Large banks in the United States are some of the most profitable corporations, especially relative to the small market shares they have.

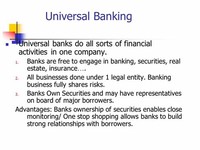

Such growing internationalization and opportunity in financial services has entirely changed the competitive landscape, as now many banks have demonstrated a preference for the “universal banking” model so prevalent in Europe.

The combination of the instability of banks as well as their important facilitating role in the economy led to banking being thoroughly regulated.

Some governments (or their central banks) restrict the proportion of a bank's balance sheet that can be lent out, and use this as a tool for controlling the money supply.

First, this includes the Gramm-Leach-Bliley Act, which allows banks again to merge with investment and insurance houses.

Universal banks are free to engage in all forms of financial services, make investments in client companies, and function as much as possible as a “one-stop” supplier of both retail and wholesale financial services.

Large corporate players were beginning to find their way into the financial service community, offering competition to established banks.

The first banks were probably the religious temples of the ancient world.

Major banks are subject to the Basel Capital Accord promulgated by the Bank for International Settlements.

The banks' main obstacles to increasing profits are existing regulatory burdens, new government regulation, and increasing competition from non-traditional financial institutions.

Banks make money from card products through interest payments and fees charged to consumers and companies that accept the cards.

Another reason banks are thoroughly regulated is that ultimately, no government can allow the banking system to fail.

The rough-hewn frontier capital, Tallahassee, gradually grew into a town during Florida's territorial period (1821-1845).

Many banks offer ancillary financial services to make additional profit; for example: selling insurance products, investment products, or stock broking.

Central banks are non-commercial bodies or government agencies often charged with controlling interest rates and money supply across the whole economy.

The development of central banks, responsible for the monetary policy of their country and with supervisory powers over banks, ensures that financial institutions do not behave recklessly or fraudulently.

Banks are susceptible to many forms of risk which have triggered occasional systemic crises.

Banks have a long history, and have influenced economies and politics for centuries.

The President, Directors and Company, of the Bank of the United States, commonly known as the First Bank of the United States, was a national bank, chartered for a term of twenty years, by the United States Congress on February 25, 1791.

Borrowers received the loan in the bank's own notes, not gold or silver coins. Stores in the 19th century often supplied coins or bank notes to their customers when they needed small amounts of money. ... Banks in the 1800s had only one employee, a cashier. Usually he was also one of the bank's principal investors.