Top Ten Credit Cards for Excellent Credit

Chase Sapphire Preferred is the rewards travel credit card that awards you 2X points on travel and dining. Apply for a Sapphire Preferred travel credit card today!

Use your VentureOne card to make travel purchases on any website or app—any airline, any hotel, rental cars and more. Redeem With Ease Once you make a travel purchase with VentureOne, redeem your miles as a statement credit toward the cost footnote 2.

With the Bank of America® Travel Rewards credit card you earn unlimited 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points. Learn more about our 20,000 online bonus points offer and apply online.

Earn travel benefits and exclusive access to unique experiences with the Platinum Card® from American Express. Terms apply.

Citi® Double Cash Card – 18 month BT offer; ... Excellent Card; No Hassles in redeeming cash ... Credit Cards > Citi® Double Cash Card – 18 month BT offer;

Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit. earn 3% cash back at US gas stations and select US department stores.

Discover it ® Miles credit card * Intro purchase APR is 0% for 14 months from date of account opening; then the standard purchase APR applies. Intro Balance Transfer APR is 10.99% for 14 months from date of first transfer, for transfers under this offer that post to your account by September 10, 2018; then the standard purchase APR applies.

Find credit cards from Mastercard for people with excellent credit. Compare credit cards from our partners, view offers and apply online for the card that is the best fit for you.

The Discover it card offers no annual fee, your free FICO Score every month and great rewards which never ... Discover Credit Cards Cash Back Credit Cards Discover it ...

One of the best cash back rewards cards on the market is the Chase Freedom credit card, which combines flat rate unlimited cash back, with bonus rewards that are available in a different category each quarter — including gas stations, restaurants, and wholesale clubs.

One of the most generous travel cards around, the Barclaycard Arrival Plus World Elite Mastercard is a great choice for earning free travel; but it’s too expensive to carry a balance on – especially since its 0 percent balance transfer offer only lasts for 12 months.

The United MileagePlus Explorer Card offers primary rental coverage in the U.S. (Coverage is always primary outside of the U.S.). Usually, credit cards only offer secondary coverage, which means you have to turn to your own car insurance company first if you have a loss while driving the rental car.

Chase Sapphire Preferred is the rewards travel credit card that awards you 2X points on travel and dining. Apply for a Sapphire Preferred travel credit card today!

The Chase Sapphire Reserve comes with some serious rewards. You earn 100,000 points as a bonus after you spend $4,000 within three months of opening your account. You also get three points for each dollar spent on restaurants and travel, and one point on everything else. In effect, the Reserve is a richer version of the Chase Sapphire Preferred.

Get all the details of Citi® Double Cash Card – 18 month BT offer including APR, annual fee, reward points, so you can apply for the right card today.

Chase Sapphire Preferred is the rewards travel credit card that awards you 2X points on travel and dining. Apply for a Sapphire Preferred travel credit card today!

Details on our top picks: the best credit cards for excellent credit Chase Freedom® Unlimited As a top tier cash back card, Chase Freedom Unlimited offers a solid 1.5% back on all purchases without the need to worry about rotating categories or keep track of different rates.

The actual amount of cash back you earn will depend on your credit limit and purchase activity. Certain terms, conditions, and exclusions apply. In order for coverage to apply, you must use your covered Mastercard® card to secure transactions.

Low interest credit cards are suitable for those that typically carry a credit card balance from one month to another. Our experts have compiled top low interest credit cards that have different perks and fees.

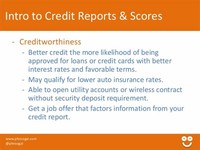

Your credit report is the basis for your credit score, which is the most influential factor in a credit card approval process, so examining the report will show you what's driving your score. If something doesn't look right on your report, file a dispute right away.

A good credit score gives you leverage to negotiate a lower interest rate on your credit card or a new loan. If you need more bargaining power, you can refer to great offers you’ve received from other companies based on your credit score.

Just because you have excellent credit doesn’t necessarily mean you automatically qualify for a sky-high limit, however. Your credit limit is relative to other factors such as income. Before the economic downfall in 2008, it wasn’t uncommon for consumers to see credit limits as high as $50,000 on a single credit card.

A bad credit score, especially if it’s caused by a previous eviction or outstanding rental balance, can severely damage your chances of getting into an apartment. A good credit score saves you the time and hassle of finding a landlord who’ll overlook damaged credit.

You buy car insurance so that you’re protected financially in the event of a car crash. But an unfair side effect of allowing credit scores to be used to set premium prices is that it effectively forces customers to dig deeper into their pockets to pay for accidents that haven’t happened and may never happen.