Types of Assurance

If a driver wishes to purchase collision coverage, many insurance companies will require the driver to purchase comprehensive coverage as well. But the opposite is not true: many insurance providers will allow a driver to purchase only comprehensive coverage and drop collision coverage.

Collision insurance is a coverage that helps pay to repair or replace your car if it's damaged in an accident with another vehicle or object, such as a fence or a tree. If you're leasing or financing your car, collision coverage is typically required by the lender.

Audit vs Assurance Auditing and assurance are processes that go hand in hand, and are usually used when evaluating a company’s financial records. Auditing and assurance are parts of the same process of verifying the information on the company’s accounting records for accuracy and compliance with the accounting standards and principles.

Comprehensive insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. Comprehensive typically covers damage from fire, vandalism or falling objects (like a tree or hail).

Comprehensive insurance is a coverage that helps pay to replace or repair your vehicle if it's stolen or damaged in an incident that's not a collision. Comprehensive typically covers damage from fire, vandalism or falling objects (like a tree or hail).

Part AIntroductionThe Social and environmental auditing refers to the auditing of organizations social andenvironmental reporting requirements and reporting thereon going beyond financial statementsauditing. In this case auditors are providing assurance services to the organizations social andenvironmental activities.

External audit firms are responsible for providing reasonable assurance that the financial statements are free from material misstatements and prepared according to an accounting framework. External auditors are not there to fix the problems, although many will provide you with recommendations.

A financial audit is an independent, objective evaluation of an organization's financial reports and financial reporting processes. The primary purpose for financial audits is to give regulators, investors, directors, and managers reasonable assurance that financial statements are accurate and complete.

A forensic audit and a financial statement audit have separate objectives that do not overlap. Request a forensic audit if you suspect asset-theft fraud. Request a financial statement audit for assurance that your business's financial statements, in all material respects, fairly state the company's financial position as of a certain date.

In a case like this, gap insurance would pay the $900 difference between what collision insurance covers ($15,000) and what you owe on the car ($17,400). If you did not have gap insurance, the extra $2,400 would come out of your pocket.

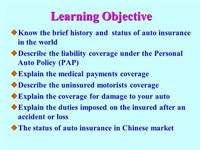

Auto liability insurance is a type of car insurance coverage that's required by law in most states. If you cause an accident, liability coverage helps pay for the other person's expenses. There are two types of auto liability coverage that drivers in each state must have: bodily injury liability coverage and property damage liability coverage.

Auto liability insurance is a type of car insurance coverage that's required by law in most states. If you cause an accident, liability coverage helps pay for the other person's expenses. There are two types of auto liability coverage that drivers in each state must have: bodily injury liability coverage and property damage liability coverage.

PIP coverage and medical payments coverage are similar in that they mainly cover injuries suffered in a car accident. Note, however, that these coverage types do differ in the following ways: In most no-fault states, PIP is a required coverage and not an option.

PIP stands for personal insurance protection (personal injury protection), and it is an extension of car insurance that covers medical expenses and, in many cases, lost wages. It is often called “no-fault” coverage because its inherent comprehensiveness pays out claims agnostic of who is at fault in the accident.

Audit protocols are applied to a specific provider or category of service in the course of an audit and involve the Department’s application of articulated Medicaid agency policy and the exercise of agency discretion.

A statutory audit is an audit that is required by a government agency and does not pertain to all businesses in the UK. For example, statutory audits are required specifically by institutions, such as banks, brokerage companies and insurance companies in the UK. This is because these types of businesses need to comply with very specific financial regulations, such as capital requirements and ...

In the case of an audit, the responsible party is the management of the company, the practitioner is the audit firm and the users are primarily the shareholders. Agreed subject matter – in the case of an audit, this would be the annual accounts of a company.

Being "underinsured" means a person has insurance coverage, but the limits may not be high enough to cover the full expenses of a claim. Take car insurance, for example: Each state requires auto liability coverage and sets minimum limits that drivers must purchase.

Understand uninsured and underinsured motorist coverage, and uninsured bodily injury: learn how it works, where it is required, what it costs, whether or not you need it and more.

Understand uninsured and underinsured motorist coverage, and uninsured bodily injury: learn how it works, where it is required, what it costs, whether or not you need it and more.