Types of Bank Accounts

Here’s what a money market account isn’t: It isn’t a checking account. Some MMAs have check-writing and debit card features. But, as with savings accounts, they are limited by the Federal Reserve to six “convenient” transfers or withdrawals a month — including by check, debit card swipe or online transfer.

The Easy Checking Account is a basic checking account that comes with great standard benefits. Learn more about the included features such as mobile banking. Learn more about the included features such as mobile banking.

? Business Bank Account Loan Financial Assistance for Car Payments impactcashusa-com Assistance in Paying Rent [Business Bank Account Loan] Need More Money

Writing in the Cash book amounts to completion of posting in the ledger accounts within the cash book i.e. the Cash a/c and Bank a/c. Posting into the other account involved in the transaction has to be done and that cannot be assumed to be complete.

Cash management is not a single service. It is the design and implementation of many bank services customized to the unique needs of your company. Collection Services-Learn about Millennium Bank's Lockbox services, Automated Electronic Payment Collection, and Cash Concentration services.

A market-linked CD (MLCD) is also referred to as an equity-linked CD, market-indexed CD or simply an indexed CD as well. It is a specific type of certificate of deposit that is linked to the performance of one or more securities or market indexes, like the S&P 500.

A CD, or certificate of deposit, is a type of savings tool that can offer a higher return on your money than most standard savings accounts. Better yet, there isn’t much risk involved, and CDs typically don’t have monthly fees.

Bank Accounts That Can Be Funded With A Credit Card When you open a new savings or checking account, some banks give you the option of using your credit card for the initial deposit. On this page we’ve got a number of data points for which banks (and credit cards) count as cash advances and which don’t.

A debit card is a more convenient way to spend money than by using cash. Find out more about what it is, how it differs from credit cards and prepaid debit cards, and how to get one.

Linking your checking account to an interest-bearing savings account is an option if you can't get a checking account that pays interest. This can be done within your existing bank (transfers between checking and savings are more or less instant), or you can link to an external account.

Definition of expense accounts Expense accounts are categories within the business's books that show how much it has spent on its day-to-day running costs. A debit to an expense account means the business has spent more money on a cost (i.e. increases the expense), and a credit to a liability account means the business has had a cost refunded or reduced (i.e. reduces the expense).

Here we're going to discuss the Income Statement Portion of the Chart Of Accounts (Revenues and Expenses) and how it's organized, The Income Statement portion of the chart of accounts normally begins by listing Revenue Accounts followed by the Expense Accounts.

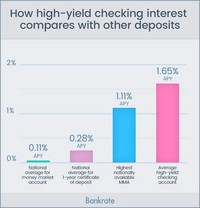

With an interest-bearing checking account, you can earn interest on the money you deposit and end up saving more money. In this article, we will explain the interest-bearing checking account definition, so you can determine if this account is right for you and your financial goals.

Individual Retirement Accounts (IRAs) Retirement may be here before you know it, but it won’t be here before you’re ready when you grow your savings with an FDIC-insured Individual Retirement Account¹.

A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a specific date, usually at the end of an accounting period, such as a quarter or a year.

What is 'Money Market Account' A money market account is an interest-bearing account that typically pays a higher interest rate than a savings account, and which provides the account holder with limited check-writing ability. A money market account thus offers the account holder benefits typical of both savings and checking accounts.

A savings account is a bank account where you can store money you don't need right away but still keep it easily accessible. Savings accounts typically earn interest and — unlike investment accounts — they're federally insured.

The Undeposited Funds account is an Other Current Asset account that’s automatically created by QuickBooks to record funds received by a company that are not immediately deposited in a bank account. When you record customer payments by clicking on the Customers->Receive Payments menu selection, you’re recording individual receipts.