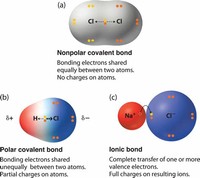

Types of Bonds

Polar Bond Definition. A polar bond is a covalent bond between two atoms where the electrons forming the bond are unequally distributed. This causes the molecule to have a slight electrical dipole moment where one end is slightly positive and the other is slightly negative.

cash bond. Definitions (2) 1. General: An arrangement wherein a party gives to another an amount of money to secure the fulfillment of an obligation. In cases where the party fails to comply with the obligation, the money is forfeited in favor of the latter.

A foreign bond is a bond issued in a domestic market by a foreign entity in the domestic market's currency as a means of raising capital. For foreign firms doing a large amount of business in the domestic market, issuing foreign bonds, such as bulldog bonds, Matilda bonds and samurai bonds, is a common practice.

A high-yield bond is a high paying bond with a lower credit rating than investment-grade corporate bonds, Treasury bonds and municipal bonds. Because of the higher risk of default, these bonds pay a higher yield than investment grade bonds.

Hydrogen bonding, interaction involving a hydrogen atom located between a pair of other atoms having a high affinity for electrons; such a bond is weaker than an ionic bond or covalent bond but stronger than van der Waals forces.

An investment grade is a rating that indicates that a municipal or corporate bond has a relatively low risk of default. Bond rating firms, such as Standard & Poor's and Moody's, use different designations consisting of upper- and lower-case letters 'A' and 'B' to identify a bond's credit quality rating.

Bond secured by a lien on the bond issuer's assets and payable from the issuer's income. Unlike a mortgage backed pass-through security (which conveys an ownership right), these bonds instead offer a more predictable maturity and, thus, a type of call protection against the bond's early redemption.

A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures, including the construction of highways, bridges or schools. Municipal bonds are exempt from federal taxes and most state and local taxes, making them especially attractive to people in high income tax brackets.

Bonds and Securities Information dealing with purchase, redemption, replacement, forms, and valuation of Treasury savings bonds and securities is located at the TreasuryDirect.gov site, which is managed by the Bureau of the Fiscal Service.

A personal bond, which is also called personal recognizance and own recognizance, is a written contract in which a person who has been arrested agrees to appear at all required court dates and promises to abstain from breaking the law while the personal bond is in force.

In states where property bonds are allowed, the types of property that can be used for collateral include homes, vacation homes, land and commercial buildings. As a general rule, if the court determines that there is more than enough equity to cover the amount of the bond, it will consider the property for use as collateral.

Surety bond definition: a legally binding contract that ensures obligations will be met between a principal (whoever needs the bond), an obligee (the one requiring the bond) and a surety (the insurance company guaranteeing the principal can fulfill the obligations).

Treasury Bonds. Treasury bonds pay a fixed rate of interest every six months until they mature. They are issued in a term of 30 years. You can buy Treasury bonds from us in TreasuryDirect.