Types of Collateral

A blanket lien is a lien that gives the right to seize, in the event of nonpayment, all types of assets serving as collateral owned by a debtor. A blanket lien is a lien that gives the right to seize, in the event of nonpayment, all types of assets serving as collateral owned by a debtor.

A cash secured loan is a loan that you guarantee by depositing funds with your lender. You “qualify for” the loan primarily based on the lender’s ability to take the cash if you stop making payments on the loan.

Inventory financing is an asset-backed, revolving line of credit or short-term loan made to a company so it can purchase products for sale. Those products, or inventory, serve as collateral for the loan if the business does not sell its products and cannot repay the loan.

Invoice discounting is the practice of using a company's unpaid accounts receivable as collateral for a loan, which is issued by a finance company. This is an extremely short-term form of borrowing, since the finance company can alter the amount of debt outstanding as soon as the amount of accounts receivable collateral changes.

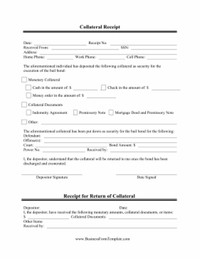

Collateral is a property or other asset that a borrower offers as a way for a lender to secure the loan. If the borrower stops making the promised loan payments, the lender can seize the collateral to recoup its losses.