Types of Employee Benefits

But, the hourly or non-exempt employee rarely has a base salary. Some employers guarantee hourly employees that they will pay them for a minimum number of hours worked. This allows the employees to plan financially, but it is not the same as receiving a base salary as exempt employees do.

An employee benefits package includes all the non-wage benefits, like insurance and paid time off, provided by an employer. There are some types of employee benefits that are mandated by law, including minimum wage, overtime, leave under the Family Medical Leave Act, unemployment, and workers compensation and disability.

Merit pay, unlike profit sharing or similar bonus pay schemes, allows an employer to differentiate between the performance of the company as a whole and the performance and contributions of an individual.

Commission: Employer Benefits. Employers benefit from paying a commission to their employees because it means that they only pay the employee if there is a sale. This eliminates the burden of paying employees for work that does not result in sales.

A group health plan is an employee welfare benefit plan established or maintained by an employer or by an employee organization (such as a union), or both, that provides medical care for participants or their dependents directly or through insurance, reimbursement, or otherwise.

When a legal holiday falls on a Saturday, the employee is granted eight hours of floating legal holiday (prorated, if part-time). When a legal holiday falls on a Sunday, the legal holiday is observed and the UW System is closed on the Monday following the legal holiday.

The FLSA, with some exceptions, requires bonus payments to be included as part of an employee's regular rate of pay in computing overtime. Extra pay for working weekends or nights is a matter of agreement between the employer and the employee (or the employee's representative).

The biggest difference between a 401(k) plan and a traditional pension plan is the distinction between a defined benefit plan and a defined contribution plan. Defined benefit plans, such as pensions, guarantee a given amount of monthly income in retirement and place the investment risk on the plan provider.

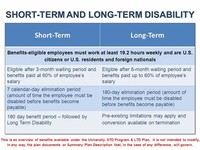

A short term disability policy can be an employer or employee paid benefit. Generally, though, short term disability coverage is employer-paid. Companies do have a choice of having employees pay for coverage, with certain tax implications.

Stock options benefit both employees and employers. Along with two basic types of option plans (incentive stock options and nonqualified option plans), there is flexibility in constructing plan contents.

Accounting for allowances and benefits ... Payments made to cover meal or clothing allowances ... A travelling allowance is paid to an employee for travel ...

Paid vacation days are time off from work that employers provide to employees as a benefit. Find out how this works and see how yours compares to others. Paid vacation days are time off from work that employers provide to employees as a benefit.