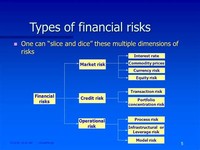

Types of Financial Risk

Financial risk refers to a company's ability to manage its debt and financial leverage, while business risk refers to the company's ability to generate sufficient revenue to cover its operational expenses.

Compliance risk is exposure to legal penalties, financial forfeiture and material loss an organization faces when it fails to act in accordance with industry laws and regulations, internal policies or prescribed best practices.

Credit risk is the probable risk of loss resulting from a borrower's failure to repay a loan or meet contractual obligations. Traditionally, it refers to the risk that a lender may not receive the owed principal and interest, which results in an interruption of cash flows and increased costs for collection.

Financial risk is the possibility that shareholders or other financial stakeholders will lose money when they invest in a company that has debt if the company's cash flow proves inadequate to meet its financial obligations.

Liquidity risk refers to the marketability of an investment and whether it can be bought or sold quickly enough to prevent or minimize a loss. Liquidity risk refers to the marketability of an investment and whether it can be bought or sold quickly enough to prevent or minimize a loss.

Market risk is the possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets. Market risk is the possibility of an investor experiencing losses due to factors that affect the overall performance of the financial markets.

Moral hazard is the risk that a party to a transaction has not entered into the contract in good faith, or has an incentive to take unusual business risks.

Operational risk is the risk not inherent in financial, systematic or market-wide risk. It is the risk remaining after determining financing and systematic risk, and includes risks resulting from breakdowns in internal procedures, people and systems.

Risk is inherent in any business enterprise, and good risk management is an essential aspect of running a successful business. A company's management has varying levels of control in regard to risk. Some risks can be directly managed; other risks are largely beyond the control of company management.

Reputational risk is a threat or danger to the good name or standing of a business or entity. Reputational risk can occur through a number of ways: directly as the result of the actions of the company itself; indirectly due to the actions of an employee or employees; or tangentially through other peripheral parties, such as joint venture partners or suppliers.

Mark L. Frigo and Richard J. Anderson, “Strategic Risk Assessment: A First Step for Improving Risk Management and Governance,” Strategic Finance, December 2009.

Systemic risk is the possibility that an event at the company level could trigger severe instability or collapse in an entire industry or economy.