Types of Financial Statements

A balance sheet reports a company's assets, liabilities and shareholders' equity at a specific point in time. A balance sheet reports a company's assets, liabilities and shareholders' equity at a specific point in time.

The cash flow statement (CFS) measures how well a company manages its cash position, meaning how well the company generates cash to pay it's debt obligations and fund it's operating expenses. The cash flow statement complements the balance sheet and income statement and is a mandatory part of a company's financial reports since 1987.

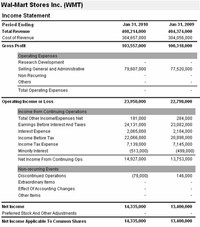

An income statement is a financial statement that reports a company's financial performance over a specific accounting period. Financial performance is assessed by giving a summary of how the business incurs its revenues and expenses through both operating and non-operating activities.

The statement of cash flows is one of the main financial statements. (The other financial statements are the balance sheet, income statement, and statement of stockholders' equity.) The cash flow statement reports the cash generated and used during the time interval specified in its heading.

Statement of changes in equity helps users of financial statement to identify the factors that cause a change in the owners' equity over the accounting periods.

statement of stockholder’s equity, often called the statement of changes in equity, is one of four general purpose financial statements and is the second financial statement prepared in the accounting cycle. This statement displays how equity changes from the beginning of an accounting period to the end.