Types of Income

A business must include in income payments received in the form of property or services at the fair market value of the property or services. The profit motive behind business income is universal to most business entities. However, how business income is taxed is treated differently for each of the most common business forms, sole proprietorships, partnerships, and corporations.

some regular payments you get as a gift or allowance; It can be in the form of: money; goods, services or other benefits in return for an item, action or promise; We use the gross amount in the income test. This is the amount before tax or any other deductions. Your income test includes income from anywhere in the world, not just Australia.

Cases in Alaska, Colorado, Montana, and Ohio have held that the interest on an IRA is income for purposes of child support. Conversely, cases in New Mexico, Louisiana, Tennessee, and Virginia have held that interest on an IRA is not income for purposes of child support. 2.

How are damage awards for personal physical ... injury or physical sickness—unless the income payments ... a personal physical injury or sickness when the ...

What is 'Investment Income' Investment income comes from interest payments, dividends, capital gains collected upon the sale of a security or other assets, and any other profit made through an investment vehicle of any kind. Generally, most people earn a large portion of their total net income through employment income.

That is, U.S. source income is the amount that results from multiplying the total amount of pay by the fraction of days in which services were performed in the U.S. This fraction is determined by dividing the number of days services are performed in the United States by the total number of days of service for which the compensation is paid.

The expenses of re-adoption are qualified adoption expenses in the year in which the expenses are paid, subject to the dollar limitation. Example. Brian and Susan paid qualified adoption expenses of $7,000 in 2014, $8,000 in 2015, and $9,000 in 2016 in connection with the adoption of an eligible foreign child from Country X. Country X is a non-Hague country (a country not party to the Hague Adoption Convention).

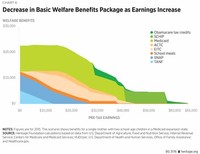

CalFresh (formerly known as Food Stamps) is an entitlement program that provides monthly benefits to assist low-income households in purchasing the food they need to maintain adequate nutritional levels. In general, these benefits are for any food or food product…