Types of Inventory

Reasons for Anticipation Inventory. The reasons that a business might purchase anticipation inventory include an expected increase in demand or concerns that the price of the inventory products purchased might increase or a shortage might occur. Businesses may also build up anticipation inventory ahead of a vacation closure or if a strike might happen. Retailers commonly build up anticipation inventory for high-demand shopping seasons, such as Christmas and Halloween.

In periodic inventory system, weighted average cost per unit is calculated for the entire class of inventory. It is then multiplied with number of units sold and number of units in ending inventory to arrive at cost of goods sold and value of ending inventory respectively.

Definition of buffer inventory: The supplies or the products of an organization that are kept available either on hand or in transit to stabilize variations in supply, demand, production, or lead time.

Cycle stock inventory is the portion of an inventory that the seller cycles through to satisfy regular sales orders. It is part of on-hand inventory, which includes all of the items that a seller has in its possession.

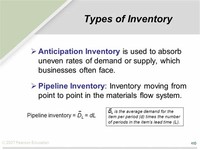

Decoupling inventory consists of inventory stock retained to make the independent control of two successive operations possible. Functions of Pipeline Inventory Pipeline inventory refers to those products that are in the company's shipping chain that have yet to reach their ultimate destination.

Check the company’s inventory records for the finished goods inventory for the preceding period. Use this amount as your goods inventory for the beginning of the current period for the calculations. For example, if the last year ended with $100,000 in finished goods, then use this amount as your starting point.

First in First out, also known as the FIFO inventory method, is one of five different ways to value inventory. FIFO assumes that the oldest items purchased are sold first. FIFO is best for businesses that sell perishable food/drink items or products that have an expiration date like certain medications.

Highest in, first out (HIFO) is an inventory distribution method in which the inventory with the highest cost of purchase is the first to be used or taken out of stock. This will impact the company's books such that for any given period of time, the inventory expense will be the highest possible for cost of goods sold (COGS) and ending inventory will be the lowest possible.

Last In First Out, also known as the LIFO inventory method, is one of five different ways to value inventory. LIFO assumes that the most recent items purchased (the newest items) are sold first. LIFO is best for businesses that sell non-perishable products that do not require refrigeration and generally have a longer shelf life.

Since the raw materials are in use, you must show the reduction in raw materials inventory by crediting the current asset account and debit the "works-in-progress" inventory. Simultaneously, you remove indirect materials by crediting raw materials inventory, but you apply the debit to a factory overhead account.

Transit inventory can sometimes create accounting and inventory conundrums for companies that fail to effectively track items being shipped from one location to another. Often referred to as "inventory in transit," these goods are typically the goods being sold from one company to another, many times from a wholesaler to a retailer who will then resell the items.

What is work-in-process inventory? You can think of work-in-process (WIP) inventory as the goods that are on the factory floor. The manufacturing of these goods has begun but has not yet been completed.