Types of Investment

An annuity is an insurance product that pays out income, and can be used as part of a retirement strategy. Annuities are a popular choice for investors who want to receive a steady income stream in retirement.

BREAKING DOWN 'Balanced Fund' Balanced funds are geared toward investors who are looking for a mixture of safety, income and modest capital appreciation. The amounts this type of mutual fund invests into each asset class usually must remain within a set minimum and maximum.

Investment products and financial services are provided through U.S. Bank and/or its affiliate, U.S. Bancorp Investments, Inc.. Stocks. Shares of stock provide an investor an ownership position in a specific corporation and represent a claim on the corporation’s earnings and assets.

A bond is a fixed income investment in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate.

Cash equivalents are investment securities that are convertible into cash and found on a company's balance sheet. Cash equivalents are investment securities that are convertible into cash and found on a company's balance sheet.

Investing style is an overarching strategy or theory used by an investor to set asset allocation and choose individual securities for investment.

An equity fund is a type of mutual fund that invests shareholder money in ownership of publicly traded businesses by buying common stock. There are countless types of equity funds to help you meet your investment goals.

Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals at reasonably predictable levels. Fixed income is a type of investment in which real return rates or periodic income is received at regular intervals at reasonably predictable levels.

A fund of funds (FOF) - also referred to as a multi-manager investment - is an investment strategy in which a fund invests in other types of funds. This strategy invests in a portfolio that contains different underlying assets instead of investing directly in bonds, stocks and other types of securities.

In the simplest sense, an index fund is an investment fund that attempts to replicate the performance of a given index of stocks or some other investment type. That can include bonds or even a narrow subset of a financial market, say, small-cap biotech companies.

An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf. An investment fund is the pooled capital of investors that enables the fund manager make investment decisions on their behalf.

What are money market funds? Money market funds are fixed income mutual funds that invest in debt securities characterized by short maturities and minimal credit risk. Money market mutual funds are among the lowest-volatility types of investments. Income generated by a money market fund is either taxable or tax-exempt, depending on the types of securities the fund invests in.

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date. An option, just like a stock or bond, is a security. It is also a binding contract with strictly defined terms and properties.

••• The best retirement investments are part of a plan. TCmake_photo/iStock One common way to create retirement income is to construct a portfolio of stock and bond index funds (or work with a financial advisor who does this).

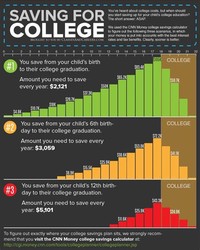

A 529 plan is a versatile savings account offering federal, and sometimes state, tax benefits, while minimizing impact on financial aid. These plans are operated by a state or educational institution, and are designed to help families set aside funds for future college and K-12 education costs.

Published by Amazon Books, Trading & Valuing Agency CMO Derivatives is a practical guide to trading mortgage derivatives or running a hedge fund or as a guide for funds of funds who are looking to allocate money to specialty fund managers.

Stocks are an equity investment that represents part ownership in a corporation and entitles you to part of that corporation's earnings and assets. Common stock gives shareholders voting rights but no guarantee of dividend payments. Preferred stocks provides no voting rights but usually guarantees a dividend payment.