Types of Pension

Invest your savings in the Bajaj Allianz Pension Guarantee, a plan that gives you a guaranteed income so that you will live worry-free for a lifetime. With Bajaj Allianz Pension Guarantee, you can ensure a regular income after retirement.

Starting and maintaining specific types of plans ... Types of Retirement Plans; Types of Retirement Plans ... (Salary Reduction Simplified Employee Pension)

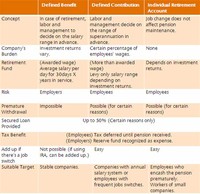

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

A defined-contribution plan is retirement plan that's typically tax-deferred, like a 401(k) or a 403(b), in which employees contribute a fixed amount or a percentage of their paychecks in an account that is intended to fund their retirements.

Social Security gets even more complex if you’re on disability, are a state employee or have a pension. What you need to know. Social Security gets even more complicated if you’re on disability, are a state employee or have a pension.

Pension plans are therefore a form of "deferred compensation". A SSAS is a type of employment-based Pension in the UK. Some countries also grant pensions to military veterans. Military pensions are overseen by the government; an example of a standing agency is the United States Department of Veterans Affairs.

Additional details about Statutory Pension Insurance. The basic and very important building block for retirement provision is the statutory pension insurance in Germany. All employees and also some groups of self-employed persons are compulsorily insured by law. In addition, there are also claims for retirement for the time spent child rearing.

Benefits Available Under HDFC Life Assured Pension Plan – ULIP A) Pension Multiplier: Loyalty additions in the form of Pension Multipliers will be added to the fund value, if all due premiums have been paid, every alternate year starting from the end of 11th policy year.

HDFC Life Click2Retire Online Pension Scheme: One of HDFC Life's best pension schemes & plans in India in 2017 that offers market linked returns to help achieve your goal.

provisions of hybrid plans (cash balance and/or pension equity plans) satisfy the applicable requirements. Therefore, you will be able to: Define a hybrid plan . Identify the primary features and requirements of a cash balance plan and a pension equity plan. Explain the "A plus B" method .

ICICI Pru Easy Retirement Plan provides pension planning with the benefit of equity participation and the comfort of a capital guarantee.

LIC Jeevan Akshay in Hindi > LIC Jeevan Akshay 6 Plan Review. LIC Jeevan Akshay VI Policy is a Single Premium Immediate Annuity Plan. How it works – You pay a Single Premium (also called the 'Purchase Price') to purchase an Annuity. LIC will then pay you regular amounts for the rest of your life.

LIC New Jeevan Nidhi is conventional deferred retirement plan. This is made to protect the risk of living a long time and therefore provides a number of pension options to cover the risk. Pension Plans available from insurance companies assist people to prepare properly for their retirement life.

Reliance Nippon Life Smart Pension Plan is a non participating unit linked pension plan that allows you to save systematically and build up the much needed lump sum to provide yourself a regular income after your retirement.

SBI Life Saral Pension is a retirement insurance policy that offers regular income and bonus, post retirement at low premium. Buy Saral Pension Scheme and secure your retirement life. SBI Life Saral Pension is a retirement insurance policy that offers regular income and bonus, post retirement at low premium.

How Social Security handles pensions gets tricky. Make sure you know the rules. ... Will My Pension Cut My Social Security Payments? How Social Security handles pensions gets tricky. Make sure you know the rules. Dan Caplinger Aug 29, 2014 at 7:03AM This article was updated on Dec. 20, 2017. For many Americans, Social Security is the only source of regular monthly income to help them ...