Types of Pension Plans

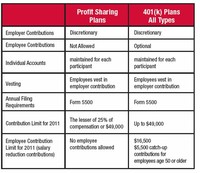

The biggest difference between a 401(k) plan and a traditional pension plan is the distinction between a defined benefit plan and a defined contribution plan. Defined benefit plans, such as pensions, guarantee a given amount of monthly income in retirement and place the investment risk on the plan provider.

Starting and maintaining specific types of plans ... Types of Retirement Plans; Types of Retirement Plans ... (Salary Reduction Simplified Employee Pension)

Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans.

A defined benefit plan, most often known as a pension, is a retirement account for which your employer ponies up all the money and promises you a set payout when you retire. A defined contribution plan, like a 401(k) or 403(b), requires you to put in your own money.

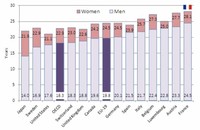

Disability benefits for employees in private pension plans Although benefits vary, for many 20 year employees aged SS, a private pension and social security

A pension is a type of retirement plan that provides monthly income in retirement. Not all employers offer pensions. Government organizations usually offer a pension, and some large companies offer them. With a pension plan, the employer contributes money to the pension plan while you are working.

Company Plans; Individual Retirement Investment; Special Section - Refund of Retirement Contributions; Ever since Germany established its first Social Security system in 1889, the public retirement insurance has been "pay-as-you-go", with the current pensions of the retired paid from the current premiums of the not yet retired.

Although an HSA is primarily a tool to garner a tax advantage while paying medical expenses, healthier individuals may find that a Health Savings Account also enables them to save even more for retirement. What is a Health Savings Account (HSA)? An HSA is a fund certain individuals may establish for their future medical expenses.

provisions of hybrid plans (cash balance and/or pension equity plans) satisfy the applicable requirements. Therefore, you will be able to: Define a hybrid plan . Identify the primary features and requirements of a cash balance plan and a pension equity plan. Explain the "A plus B" method .

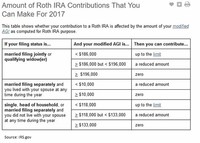

An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax deferred basis. Learn more about IRAs and how these retirement savings accounts can help you save for your retirement.

An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax deferred basis. Learn more about IRAs and how these retirement savings accounts can help you save for your retirement.

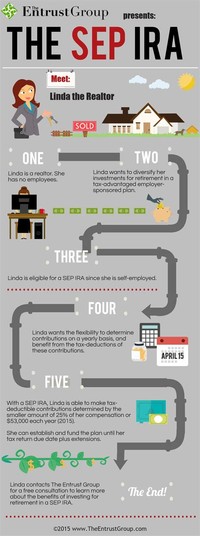

Retirement Plans; Simplified Employee Pension Plan SEP Simplified Employee Pension Plan (SEP) ... Also, see Video: Starting a SEP or SIMPLE IRA Plan.

A SIMPLE IRA plan (Savings Incentive Match PLan for Employees) allows employees and employers to contribute to traditional IRAs set up for employees. It is ideally suited as a start-up retirement savings plan for small employers not currently sponsoring a retirement plan.

While pensions are typically workplace retirement plans, in which an employer makes contributions to a pool of funds on behalf of employees, Social Security is handled by the federal government and funded through payroll taxes collected from employees and companies.

A one-participant 401(k) plan is sometimes called a: Solo 401(k) Solo-k Uni-k; One-participant k; The one-participant 401(k) plan isn't a new type of 401(k) plan. It's a traditional 401(k) plan covering a business owner with no employees, or that person and his or her spouse. These plans have the same rules and requirements as any other 401(k) plan.