Types of Retirement

The Differences Between 401(k) and 403(b) Plans Mary Hall Named after sections 401(k) and 403(b) of the tax code, respectively, both 401(k) plans and 403(b) plans are tax-advantaged retirement vehicles offered by employers. The primary difference between the two is the type of employer sponsoring the plans—401(k) plans are offered by private, for-profit companies, whereas 403(b) plans are only available to nonprofit organizations and government employers.

If advisers consider the cash value of a low-cost, long-term whole life policy as a part of a fixed-income portfolio, the policy generally will provide more income per dollar than bonds held in taxable or tax-sheltered accounts, said Michael Finke, professor of personal financial planning at Texas Tech University, who recently conducted research on cash-value life insurance in retirement.

A defined-contribution plan is retirement plan that's typically tax-deferred, like a 401(k) or a 403(b), in which employees contribute a fixed amount or a percentage of their paychecks in an account that is intended to fund their retirements.

Immediate annuities and longevity annuities are two relatively simple products that can provide guaranteed income in retirement. Say no to the most complex annuities but... Immediate annuities and longevity annuities are two relatively simple products that can provide guaranteed income in retirement.

You also need to prepare for health care costs in retirement, and one powerful tool to help you do this is a health savings account. A health savings account is a tax-exempt trust or custodial account that can be set up to pay for future medical expenses.

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis.

For example, unlike 401(k) plans, you can’t take loans from NQDC plans, and you can’t roll the money over into an IRA or other retirement account when the compensation is paid to you (see the graphic below).

A pension is a type of retirement plan that provides monthly income in retirement. Not all employers offer pensions. Government organizations usually offer a pension, and some large companies offer them. With a pension plan, the employer contributes money to the pension plan while you are working.

A Roth IRA is a special retirement account that you fund with post-tax income (you can’t deduct your contributions on your income taxes). Once you have done this, all future withdrawals that follow Roth IRA regulations are tax free.

A Roth IRA is a special retirement account that you fund with post-tax income (you can’t deduct your contributions on your income taxes). Once you have done this, all future withdrawals that follow Roth IRA regulations are tax free.

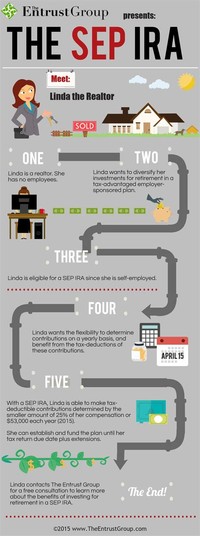

A SEP plan allows employers to contribute to traditional IRAs (SEP-IRAs) set up for employees. A business of any size, even self-employed, can establish a SEP.

A SIMPLE IRA plan (Savings Incentive Match PLan for Employees) allows employees and employers to contribute to traditional IRAs set up for employees. It is ideally suited as a start-up retirement savings plan for small employers not currently sponsoring a retirement plan.

The one-participant 401(k) plan isn't a new type of 401(k) plan. It's a traditional 401(k) plan covering a business owner with no employees, or that person and his or her spouse. These plans have the same rules and requirements as any other 401(k) plan.

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis.