Types of Savings Accounts

A: An asset is anything of value that can be converted into cash. Assets are owned by individuals, businesses and governments. Examples of assets include: Cash and cash equivalents – certificates of deposit, checking and savings accounts, money market accounts, physical cash, Treasury bills;

A savings account is a bank account where you can store money you don't need right away but still keep it easily accessible. Savings accounts typically earn interest and — unlike investment accounts — they're federally insured.

A savings account is a bank account where you can store money you don't need right away but still keep it easily accessible. Savings accounts typically earn interest and — unlike investment accounts — they're federally insured.

If a basic savings account serves you best, start your search by looking at online banks and credit unions. These types of financial institutions, which are heavily featured in NerdWallet’s list of the best online savings accounts, keep fees to a minimum, offer high rates and might even offer special tools to help you manage your savings.

Advantages of Market Linked CDs. These MLCDs seem to be a marriage between the stock market with the traditional CDs that we are familiar with. The advantages are as follows: FDIC Insurance – Yup the principal is insured to a maximum of $250,000 this year and up to $100,000 thereafter, just like any other savings accounts or CDs.

A certificate of deposit, or CD, is a type of savings vehicle in which people leave money in the bank for a set number of months or years. That’s called the term length — and the longer the term, the better the interest rate will be.

Definition: A CD, or certificate of deposit, is a savings account that has a fixed interest rate and fixed date of withdrawal, known as the maturity date. CDs also typically don’t have monthly fees.

Also, any funds distributed from a 529 plan are not taxable if rolled over to another plan for the benefit of the same beneficiary or for the benefit of a member of the beneficiary’s family. So, for example, you can roll funds from the 529 for one of your children into a sibling’s plan without penalty.

A savings account is a bank account where you can store money you don't need right away but still keep it easily accessible. Savings accounts typically earn interest and — unlike investment accounts — they're federally insured.

Regular, non-club credit union savings accounts are easier to access, making it harder to save, he says. Credit unions like Redstone Federal Credit Union in Huntsville, Ala., and Arizona Central Credit Union in Phoenix offer “You Name It” accounts to fund any savings goal you may have.

Linking your checking account to an interest-bearing savings account is an option if you can't get a checking account that pays interest. It can be done within your existing bank (transfers between checking and savings are more or less instant), or you can link to an external account.

A savings account is a deposit account held at a bank or other financial institution that provides principal security and a modest interest rate. A savings account is a deposit account held at a bank or other financial institution that provides principal security and a modest interest rate.

With the best high-yield online savings accounts, you get great rates and a safe place to keep your money. We've rounded up the best accounts for high interest rates, including Marcus by Goldman Sachs, CIT Bank, American Express National Bank, Synchrony, Discover, Barclays, Ally, Alliant Credit Union and Capital One.

The Best High-Interest Savings Accounts ... An online high-interest savings account gives ... you should look into opening a checking or savings accounts at a ...

Of the Americans who have savings accounts, the median savings account balance is $5,200. The average, or mean balance is $33,766.49. The households with high incomes seriously skew the numbers when you calculate the mean.

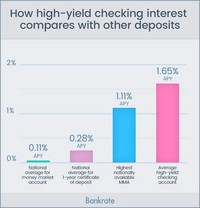

Interest checking accounts allow you to earn interest on easily accessible cash. They’re like a mix between checking accounts and savings accounts, a perfect combination for many consumers. Get a better understanding of such accounts by looking at the basics and some of the major providers of interest checking.

An individual retirement account (IRA) allows you to save money for retirement in a tax-advantaged way. An IRA is an account set up at a financial institution that allows an individual to save for retirement with tax-free growth or on a tax-deferred basis.

Save money with someone else and we'll help you reach your goals quicker. Browse our best Lloyds Bank Joint Savings Accounts to save money together.

Compare jumbo savings accounts and interest rates from hundreds of banks to help maximize your earnings. Jumbo savings accounts pay higher interest rates than regular savings accounts do, making these accounts more attractive to serious savers.

In turn, the account is a liability to the bank. There are several different types of deposit accounts including current accounts, savings accounts, call deposit accounts, money market accounts and certificates of deposit (CDs). Current Deposit Account. A current account, also called a demand account, is a basic checking account.

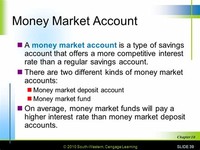

A money market account may also require a higher minimum balance than a regular savings account at the same bank. Some money market accounts may offer check-writing privileges -- up to six per month -- that can access the account's funds, whereas traditional savings accounts do not permit check-writing.

A Money Market Account (MMA) is a savings account that typically has a higher interest rate than traditional savings accounts but may require larger minimum deposits and balances. A money market account allows a limited number of checks to be drawn from the account monthly.

The best online savings accounts give you a safe place to keep your money while you’re earning top rates. Because online banks don’t have the expense of maintaining branches like traditional banks do, they can offer annual percentage yields of 1.50% or more — over 20 times higher than the national average of 0.07%.

After years of low interest rates, there is a pricing war happening for online savings accounts. Long gone are the days of 0.01% APY. If you are willing to open an online savings account (which is FDIC insured), you can now easily get a 1.65% APY or higher.

Take rewards savings accounts that link to rewards checking, which give you more bang for your buck. SuttonBank of Attica, Ohio, offers a rewards savings account with a 0.75 annual percent yield on top of the linked rewards checking’s hefty 2.01 percent yield.

A savings account is a bank account where you can store money you don't need right away but still keep it easily accessible. Savings accounts typically earn interest and — unlike investment accounts — they're federally insured.

A savings account is a deposit account held at a bank or other financial institution that provides principal security and a modest interest rate. A savings account is a deposit account held at a bank or other financial institution that provides principal security and a modest interest rate.

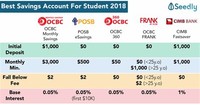

Students may have money left over from a job or their overdraft that they want to put into a student savings account. We steer you through the best student savings accounts available.

Since the Make Deposits function groups items in the Undeposited Funds account, if you need to make a non-customer payment deposit, you either need to make 2 separate deposits or you need to use a general journal entry to get these funds into undeposited funds.