Types of Securities

Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings. Capital surplus is equity which cannot otherwise be classified as capital stock or retained earnings.

A corporate bond is a debt security issued by a corporation and sold to investors. The backing for the bond is usually the payment ability of the company, which is typically money to be earned from future operations.

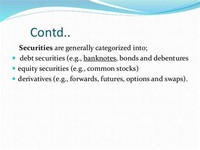

Securities ISIN.net can help with your security. A security is generally a fungible, negotiable financial instrument representing financial value. Securities are broadly categorized into: debt securities (such as banknotes, bonds and debentures), equity securities, e.g., common stocks; and, derivative contracts, such as forwards, futures ...

Derivatives. Derivatives are securities whose value is determined by an underlying asset on which it is based. Therefore the underlying asset determines the price and if the price of the asset changes, the derivative changes along with it. A few examples of derivatives are futures, forwards, options and swaps.

Derivatives. Derivatives are securities whose value is determined by an underlying asset on which it is based. Therefore the underlying asset determines the price and if the price of the asset changes, the derivative changes along with it. A few examples of derivatives are futures, forwards, options and swaps.

also called equity or stock or corporate stock. Use equity security in a sentence “ You should try to make sure that you do a lot of research when deciding which equity security to use.

also called equity or stock or corporate stock. Use equity security in a sentence “ You should try to make sure that you do a lot of research when deciding which equity security to use.

Securities are basically in three forms; debt securities, equity securities and contracts. Moreover, shares are a type of equity security that comprises the ownership certificate of a corporation. The return of a share investment is the dividend paid by the corporation plus the increase in the market value of the shares.

A commodities futures contract is not a security, but an option on that contract is considered a security - the performance is now dependent on the activities of a third party.

Retail investors buy government securities directly from the Treasury Department’s website, banks or brokers. Since most government securities are backed by the full faith and credit of the U.S. government, default is unlikely. Rates on government bonds affect the entire U.S. economy.

A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures. A municipal bond is a debt security issued by a state, municipality or county to finance its capital expenditures.

Like stocks, mutual funds are considered equity securities because investors purchase shares that correlate to an ownership stake in the fund as a whole. Equity Securities. An equity security is any investment vehicle in which each investor is a part owner of the controlling company.

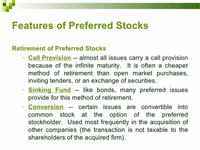

Convertible preferred securities can typically be exchanged for a specified amount of a different security, often the common stock of the issuing company. Convertible preferred securities may combine the fixed income characteristic of bonds with the potential appreciation characteristics of stocks.

Board of Governors of the Federal Reserve System. The Federal Reserve, the central bank of the United States, provides the nation with a safe, flexible, and stable monetary and financial system.

Retained earnings are the cumulative net earnings or profit of a firm after accounting for dividends and are sometimes referred to as the earnings surplus. Retained earnings are the net earnings after dividends that are available reinvestment in the company's core business or to pay down its debt.

Share capital consists of all funds raised by a company in exchange for shares of either common or preferred shares of stock. The amount of share capital or equity financing a company has can change over time.

Call options provide the option buyer with the right to buy an underlying security at the strike price, so the buyer wants the stock to go up. Conversely, the option writer needs to give the underlying security to the option buyer, at the strike price, in the event that the stock's market price exceeds the strike price.

An equity security represents ownership interest held by shareholders in an entity (a company, partnership or trust), realized in the form of shares of capital stock, which includes shares of both common and preferred stock.

U.S. Treasury securities—such as bills, notes and bonds—are debt obligations of the U.S. government. When you buy a U.S. Treasury security, you are lending money to the federal government for a specified period of time.