Types of Trust Funds

An asset-protection trust is a term which covers a wide spectrum of legal structures. Any form of trust which provides for funds to be held on a discretionary basis falls within the category.

Keep your valuables safe in our vaults with a safe deposit box. While electronic conveniences are important part of what we provide customers, we understand that traditional services, such as safe deposit boxes, play an important role for customers, too.

The Grantor: This is the person who establishes the trust fund, donates the property (such as cash, stocks, bonds, real estate, mutual funds, art, a private business, or anything else of value) to the fund, and who decides the terms upon which it must be managed.

If you own property in another state, transferring it to your living trust will prevent a conservatorship and/or probate in that state. Your attorney can contact a title company or an attorney in that state to handle the transfer for you.

The Grantor: This is the person who establishes the trust fund, donates the property (such as cash, stocks, bonds, real estate, mutual funds, art, a private business, or anything else of value) to the fund, and who decides the terms upon which it must be managed.

Charitable giving that gives back Charitable ... Generally, once you fund a charitable trust, these assets are out of your estate for estate tax purposes.

A constructive trust is not a trust, in the true meaning of the word, in which the trustee is to have duties of administration enduring for a substantial period of time, but rather it is a passive, temporary arrangement, in which the trustee's sole duty is to transfer the title and possession to the beneficiary.

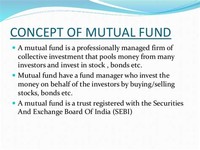

The risk is spread across the investments. If the stock of any one company doesn't perform as expected, the other companies' stock performances compensate -- at least that's what the fund manager hopes. When you buy shares in the mutual fund, that's what you own. You don't own the stock of the companies in the mutual fund portfolio.

An Irrevocable Trust and Creditors An irrevocable trust can protect your assets if you work in a profession that puts you at risk for certain lawsuits -- or even if you don't. You can't take the property back after you transfer ownership into an irrevocable trust, so it's safe from creditors and anyone who holds a judgment against you if you want to ensure that it's preserved for your beneficiaries.

Life insurance can be an inexpensive way to pay estate taxes and other expenses. So you can leave more to your loved ones. 7. How does an irrevocable insurance trust work? An insurance trust has three components. The grantor is the person creating the trust -- that's you. The trustee you select manages the trust.

An ILIT is a type of living trust that's specifically set up to own a life insurance policy. You can transfer ownership of an existing policy to the ILIT after it's been formed, or the trust can purchase the policy directly.

You may have unclaimed funds in old bank accounts, from insurance premium refunds owed to you, utility deposits, dividend payments, escrow accounts, or because of wages owed to you by a former employer.

Maintain an individual combined balance of $50,000 or more for all T. Rowe Price accounts (including mutual funds, Brokerage, and Small Business Retirement Plans); or Qualify for T. Rowe Price Select Client Services based on higher asset levels of $100,000 or more.

Non-Qualified - after-tax money, which includes, but not limited to, the following: Certificates of Deposits (CDs); Annuities; Mutual Funds; Money Markets; and; Savings. With a non-qualified plan, there are no deductions, but the principal is never taxed twice. Instead, the interest is taxed once withdrawn. Also, there are no RMDs on nonqualified plans.

Generally, assets you want in your trust include real estate, bank/saving accounts, investments, business interests and notes payable to you. You will also want to change most beneficiary designations to your trust so those assets will flow into your trust and be part of your overall plan.

A grantor may choose to transfer real property into a trust. For trustees, funding a trust with real estate involves transferring the property’s title, drafting a new deed and getting it signed, and assuming responsibility for the property.

A revocable trust is a trust whereby provisions can be altered or canceled dependent on the grantor. A revocable trust is a trust whereby provisions can be altered or canceled dependent on the grantor.

The person serving as trustee of the special needs trust can usually pay for anything for the person with special needs, as long as the purchase is not against public policy or illegal and does not violate the terms of the trust.

A spendthrift trust puts restrictions on the beneficiary’s access to trust principal. Essentially, the beneficiary cannot access the trust principal, or promise it to anyone else. Because the beneficiary cannot access trust funds, neither can his or her creditors.

Stocks and Bonds Held in Certificate Form The original certificate must be returned to the stock transfer agent in exchange for a new certificate. This requires obtaining a "Medallion Signature Guarantee" on the stock transfer form and mailing the original certificates via registered mail and insuring the shares for 2% of their current fair market value.

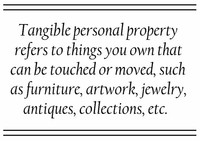

This property is distinct from other assets you may own, such as your home (real property) or securities (intangible personal property). If you have a Revocable Trust, it may be a good idea to transfer ownership of some tangible personal property items into your Trust.

“A spousal bypass trust provides the potential for inheritance tax savings of up to 40 per cent of the value of pension funds, while leaving the option for the surviving spouse to benefit from the funds if required.”