Types of Life

However, guaranteed issue life insurance generally offers low death benefit options with higher than normal premiums. The three main benefits of guaranteed issue life insurance are that there is no required medical examination, no medical questions to answer, and you don't have to be in perfect health.

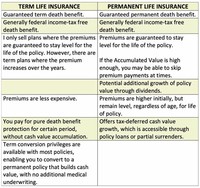

Permanent life insurance is one of the most confusing topics in personal finance. This makes a discussion of whether to buy term or permanent insurance a daunting task.

"Simplified issue" means you answer a few questions about your medical history for the life insurance application, rather than undergoing a medical exam. "Guaranteed issue" means you don't have to answer any medical questions or go through a medical exam.

More common than annual renewable term insurance is guaranteed level premium term life insurance, where the premium is guaranteed to be the same for a given period of years. The most common terms are 10, 15, 20, and 30 years.

As a result, universal life insurance premiums are typically lower during periods of high interest rates than whole life insurance premiums, often for the same amount of coverage. Another key difference would be how the interest is paid.

Variable life insurance is a permanent life insurance product with separate accounts comprised of various instruments and investment funds, such as stocks, bonds, equity funds, money market funds, and bond funds.

Variable universal life insurance (VUL) is a permanent life insurance policy with a savings component in which cash value can be invested. Variable universal life insurance (VUL) is a permanent life insurance policy with a savings component in which cash value can be invested.

Find out if whole life insurance is right for you - including how it works, rates, pros & cons, and how to choose a good policy.